There are often stories beyond the numbers.

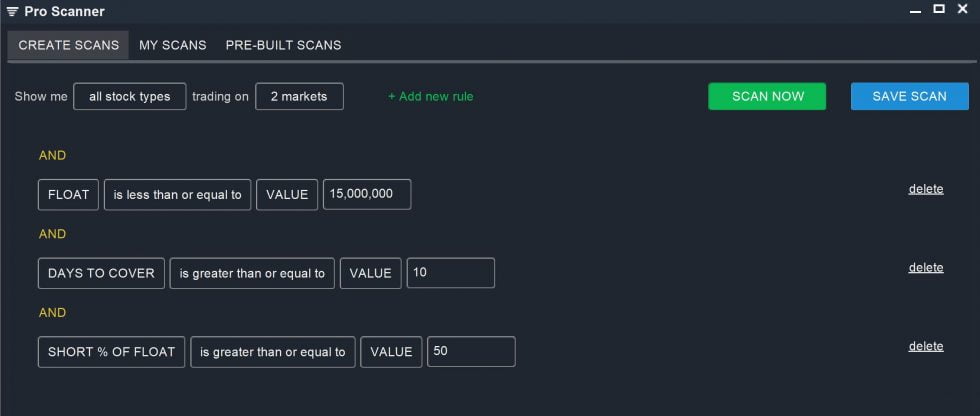

#Short squeeze screener professional#

Typically, professional traders might sell short if they are bearish on a certain stock or industry, or they may be angling for a management shake-up at a company or some other change. Short selling tends to be associated with the realm of hedge fund traders and other experienced market professionals with large amounts of capital and the capacity to absorb losses when the market moves against them.

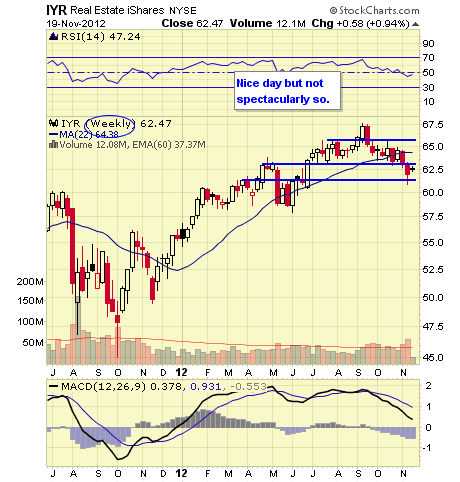

Granted, this is an oversimplified explanation of the process of short selling stocks, so before you jump in to such a trade, learn about the specifics, such as margin accounts, margin calls, “hard-to-borrow” shares, and other unique characteristics of short selling. On the other hand, a short seller holding a losing position may receive a margin call and be required to put up more money. For example, if a stock shorted at $50 is bought back at $40, the seller realizes a $10 per-share profit (minus transaction costs). If the price drops, the investor can buy back the stock at the lower price and pocket the difference. At some point, the investor must close the short position by buying back the same number of shares and returning those shares to the broker. Investors who sell short borrow stock from a broker and then sell the shares. Before you consider initiating a short position, it’s important to understand the basics.īut even if you have no intention of becoming a short seller, getting a handle on what short sellers are doing and why, as well as what that activity might say about a company, industry, or broader market could give you some added perspective as an investor. That may seem straightforward enough, but short selling stocks can quickly get complicated and risky. What Is Short Selling?Ī short position is essentially a trade that aims to profit from a decline in the price of a stock or asset. But by understanding the basics of short selling and so-called “short interest,” investors can gain valuable insights into companies and markets. It’s also not for everyone, as there are numerous risks, and the mechanics are somewhat complex. Short selling plays a role in price discovery and liquidity-two components of healthy and efficient markets. They’re called short sellers, aka “shorts.” And a few of them made the headlines in 2021 as a few heavily shorted stocks rocketed higher in apparent short squeezes (more on that in a bit). Consider monitoring short interest metrics, even if you’re an investor with no intention of short sellingīuy low sell high-it’s the first rule of trading.īut some traders and fund managers flip the order by selling first and hoping to buy back later at a profit.The short interest ratio is one way to identify possible “short squeeze” targets.

Short selling may have negative connotations, but it plays a role in liquidity and price discovery

0 kommentar(er)

0 kommentar(er)